Lump Sums are typically used to simplify the relocation process. However, there are multiple considerations when deciding if it is right for your mobility program.

It can be a balancing act with company goals, budgets employee needs, and expectations that must be met and managed.

First Glance

As a mobility solution, lump sums seem straightforward. Simply stated, a lump sum is a cash payment to a transferring employee in lieu of all, or specific relocation benefits.

At first glance, a lump sum seems to balance all needs. The positive aspects are:

- A lump sum meets the company’s mobility goals and gets the employee or new hire from one location to another

- A lump sum can provide cost savings or at least cost containment, and provides easy budgeting and administration

- A lump sum provides the employee with flexibility to use the funds as needed/desired.

Considerations and Complexities

Sounds good so far. But consider this: would the company ever provide a lump sum to all its business travelers instead of reimbursing actual expenses for business trips (ignoring the taxability issue)? The likely answer is no, because some employees would receive a windfall and others would complain – loudly – that the lump sum amount was not enough. Lump sums for relocation are a similar concept.

In addition, dig a little deeper, and the complexity of lump sums starts to be revealed. Start at the top and consider a company’s culture when determining if a lump sum is right for the mobility program. How does the company perceive itself and how does it want to be perceived? What about the employee experience? Is the company comfortable with a “you are on your own” type of relocation? It’s important to remember that lump sums can impact company productivity and revenue because the employee is managing the move on his/her own, looking for low-cost suppliers so the lump sum can be maximized. This can also create issues for the company’s Mobility group, which may be drawn into problem resolution when employees encounter challenges with their choices.

Other considerations that should be carefully examined before implementing a lump sum include:

- The type of lump sum (in lieu of all relocation benefits or some? If it’s the latter, which ones?)

- The population that will receive the lump sum (all relocating employees, lower level new hires, or specific policy levels?)

- The impact a lump sum may have on the company’s recruiting efforts (assess the difficulty in attracting desired talent)

- The lump sum’s financial impact on the employee (overpayment for some, underpayment for others)

- The company’s exception philosophy (what happens if the lump sum is too low? Will additional funds be approved? How to control exceptions/cost?)

Budget

And then there is the question of budget, which can be especially thorny. Not only does the company have to determine its overall relocation budget and potential spend, but it then has to determine how to calculate the lump sum, regardless of whether the lump sum is intended for all benefits or just some. Who will determine the amount? Does the company have historical data on which to base the lump sum? Will the amount be fixed, or will it vary by employee level, homeownership status, distance to the new location, family size, etc.? If the amounts are fixed, how often will they be updated? Will the lump sum be tax assisted (grossed up)?

No matter how they are structured, lump sum payments are taxable income to the employee. However, a company that provides a lump sum that covers home sale expenses may be spending unnecessary dollars because a properly structured home sale program can result in tax benefits that are unavailable if a lump sum is used.

The Numbers

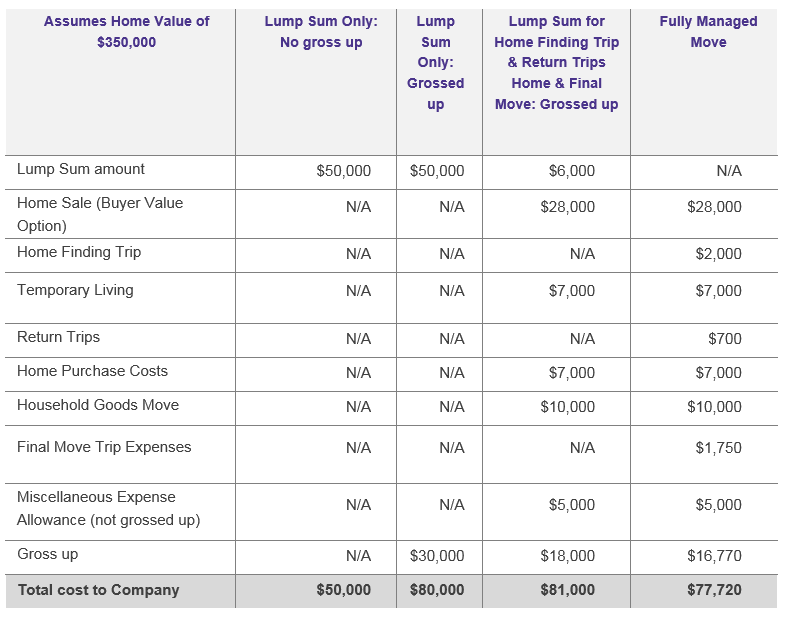

Looking at several lump sum scenarios can be helpful to the decision-making process:

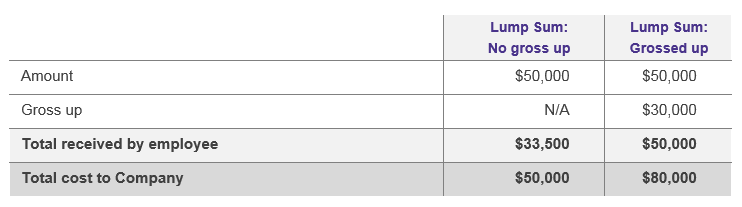

Lump Sum In Lieu of All Relocation Benefits

Gross up increases costs to the company, but not grossing up results in a significantly reduced payment, which may result in financial hardship for the employee. This can trigger exception requests or even cause the relocation to fail.

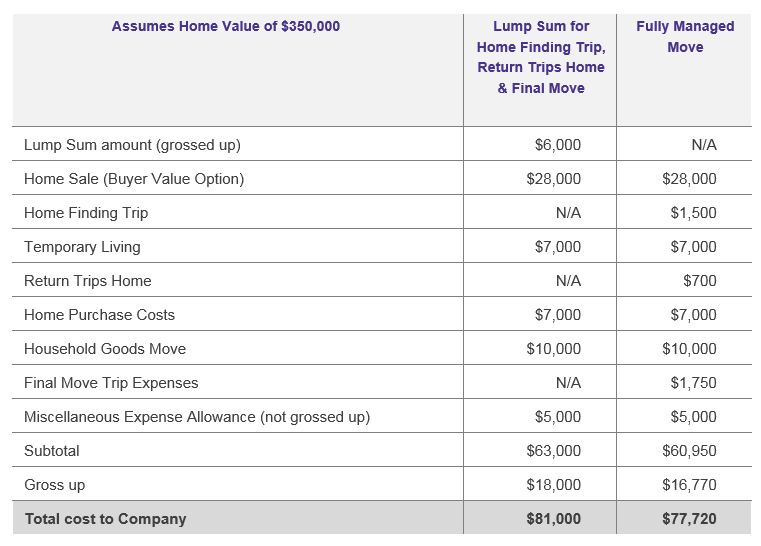

Lump Sum for Certain Relocation Benefits

Historical data, when available, can be critical when considering a lump sum. Upon analyzing historical data of their home finding trip costs, one company decided against a lump sum because it was discovered that the majority of employees used only part of the allowed time or did not take a home finding trip. A lump sum would have increased their overall spend.

Combining the various scenarios can be enlightening and helps the company understand the immediate, hard costs for lump sum programs. The unknown costs of lost revenue and lower employee productivity, marketplace reputation in the industry and possible exceptions that can result from certain lump sum programs are harder to quantify.

These scenarios illustrate that an off-the-cuff decision on lump sums is never a good idea. Careful forethought is highly recommended to ensure that decisions that impact the mobility program are the right ones for the company and maintain that all important balance of managing costs, meeting recruitment goals and providing support to relocating employees.